Highlights

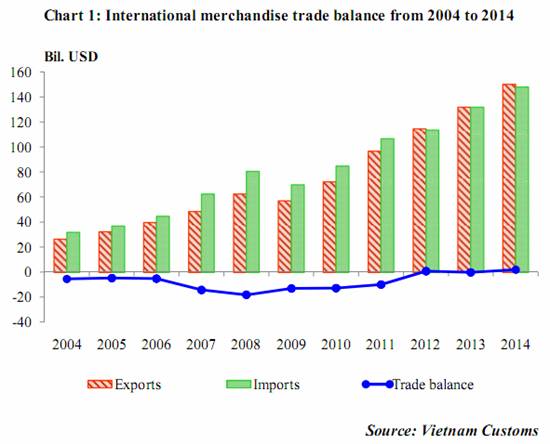

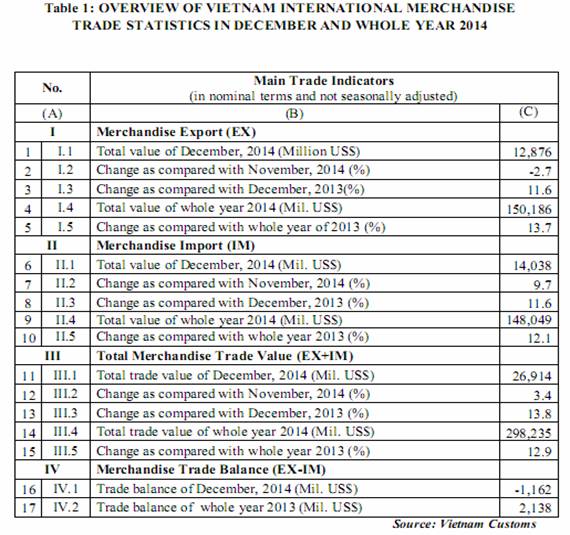

1. According to trade statistics of Vietnam Customs, in December of 2014, a 3.4% decrease in total external merchandise turnover of Vietnam was recorded as compared to the result of a month earlier. In which, exports went down 2.7 %, to USD 12.88 billion and imports expanded 9.7%, to USD 14.04 billion. As a result, there was a USD 1.16 billion deficit in Vietnam’s trade balance in this month.

2. Total value of Vietnam’s- trade-in-good was recorded at USD 298.24 billion, 12.9% (or USD 34.17 billion) higher than the performance of one year before. There were upwards in total value of both merchandise exports (13.7%, to USD 150.19 billion) and merchandise imports (12.1%, to USD 148.05 billion). Accordingly, from the beginning to the end of 2014, Vietnam Customs recorded the highest surplus in Vietnam’s trade balance, which reached USD 2.14 billion.

3. Trade data disseminated recently by Vietnam Customs announced that the total value of exportation and importation by foreign direct invested (FDI) traders reached USD 178.18 billion in total for whole year 2014, up by 14.7 % as compared to the result of 2013. Total value of FDI exportation was USD 94.0 billion, expanded by 16.1%. On import side, the total value of those companies was USD 84.18 billion, picked up by 13.1%.

Main Exports and Imports

4. The November to December of 2014 decrease in total merchandise exports was due to the downturns in telephones, mobile phones and parts thereof (down by USD 873 million), computers, electrical products and parts thereof (down by USD 428 million); rice (down by USD 85 million). In contrast to this result, there were still sharp upturns in value of the following commodities: textiles and garments (up by USD 426 million); foot-wears (up by USD 132 million); wood and wooden products (up by USD 66 million); coffee (up by USD 63 million).

In 2014, there were more 2 exported commodities reaching over USD billion than 2013, to 23commodities. The value of these was expanded by 13.8%, to USD 128.88 billion in total as compared to the result of those in 2013 and accounted for 85.8% total merchandise exports value.

The performance growth in total exports value of 2014 as compared to that of 2013 was contributed by the upwards of the following goods: textiles and garments (up by USD 3.02 billion); foot-wears (up by USD 1.94 billion); machine, equipment, tools and instruments (up by USD 1.29 billion); fishery products (up by USD 1.14 billion); computers, electrical products and parts thereof (up by USD 838 million)…

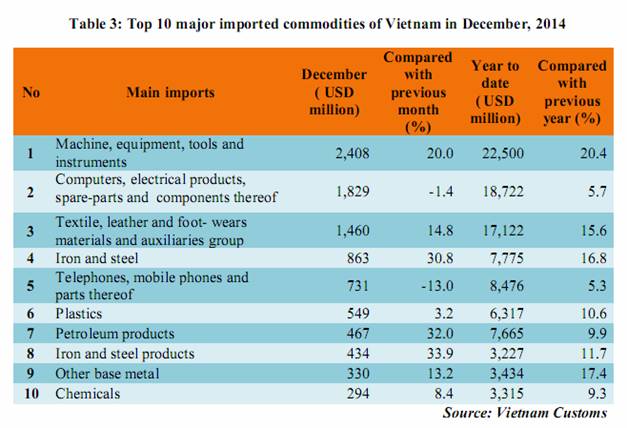

5 The following Table released by Vietnam Customs illustrates 10 biggest major imported commodities of Vietnam from rest of the world in December 2014. The leading imported products of the country from the world market included: Machine, equipment, tools and instruments (USD 2,408 million); computers, electrical products, spare-parts and components thereof (USD 1,829 million);textiles, leather and foot-wears materials and auxiliaries group (USD 1,460 million); iron and steel (USD 863 million); telephones, mobile phones and parts thereof (USD 1,722 million); …

In 2014, there were more 5 imported commodities reaching over USD billion than 2013, to 29 commodities. The value of these reached USD 127.05 billion in total as compared to the result of those in 2013 and accounted for 85.8% total merchandise exports value.

The performance growth in total imports value of 2014 as compared to that of 2013 was contributed by the upwards of the following goods: machine, equipment, tools and instruments (up by USD 3.82 billion); computers, electrical products and parts thereof (up by USD 1.44 billion); iron and steels (up by USD 1.12 billion); fabrics (up by USD 1.09 billion);..

On the other hand, there were strong decrease in value of the following goods: other means of transportation, parts and accessories thereof (down by USD 849 million); crude oil (down by USD 571 million) and fertilizers (down by USD 466 million).

Trading Partners

6. In 2014, Vietnamese merchandise trade with trading partners in Asia was totaled USD 197.26 billion in value terms, which moved up 11.7% as compared to the same period of one year before. Trade-in-goods of Vietnam with America was followed, which reached USD 46.74 billion and increased by 23.6%. The values of other continents were: Europe: USD 42.59 billion, up by 7.7%; Oceania: USD 6.93 billion, up by 19.1% and Africa: USD 4.71 billion, up by 9.7% in comparison with the performance of 2013.

7. From January to December of 2014, Vietnam traded with over 200 trading partners. There were 28 exporting markets and 18 importing markets with over USD 1 billion revenue.

| Value level |

Exports |

Imports |

| Markets |

Value

(Mil.USD) |

Markets |

Value

(Mil.USD) |

| Above 1 Bil. USD |

28 |

133.98 |

18 |

132.78 |

| 500 Mil.USD – 1 Bil.USD |

7 |

4.6 |

9 |

5.83 |

| 100 Mil.USD – 500 Mil.USD |

32 |

7.4 |

28 |

6.56 |

| Below 100 Mil. USD |

171 |

4.21 |

183 |

2.88 |

Source: Vietnam Customs

For Jan – Dec period of 2014, there were 17 exporting markets with trade surplus of over USD 1 billion. The United States of America posted the biggest trade surplus of USD 22.37 billion. United Arab Emirates and Hong Kong posted the second trade surplus of USD 4.16 billion and then: Netherland (USD 3.22 billion); United Kingdom (USD 3 billion); Germany (USD 2.54 billion)…

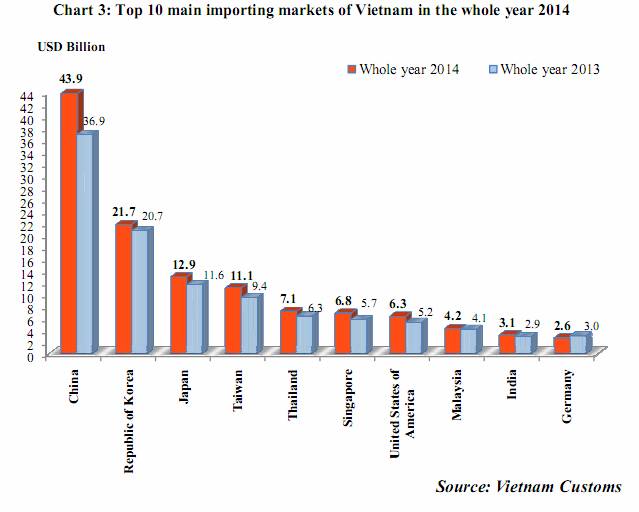

8. In 2014, there were 6 importing markets with trade deficit of over 1 billion. China was the market that Vietnam had the largest trade deficit with USD 28.96 billion. The following positions were: Republic of Korea (USD 14.6 billion); Taiwan (USD 8.78 billion); Singapore (USD 3.93 billion); Thailand (USD 3.86 billion)…